philadelphia wage tax rate

Earnings Tax employees Due date. The July 1 st city wage tax increase will take effect the same week that Philadelphia moves into the green phase for businesses to reopen.

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

The employee rate for 2022 remains at 006.

. Residents of Philadelphia will pay 38712 percent in taxes for the 2019 tax year. Additionally to the Pennsylvania income tax and the Federal income tax residents of Philadelphia pay a flat city income tax of 393 percent on their earned income which is on top of the state. After gross income less standard deduction that is taxable income subject to.

And of Pennsylvanias 500 school districts 472. See below to determine your filing frequency. Is there a school income tax in Philadelphia that I have to pay.

The City of Philadelphia Department of Revenue Announces Wage Tax Reduction for July 1 2015. Just like federal income taxes your employer will withhold money to cover this state income tax. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

At its height the Philadelphia Wage Tax reached 496 in 1985. The Earnings Tax closely resembles the Wage Tax. Since the mid-1990s Philadelphia mayors have worked to lower the rate.

The main difference is how the tax is collected and paid to the City of Philadelphia. The new Wage Tax rate for non-residents of Philadelphia who are subject to the Philadelphia City Wage Tax is 34567 034567. The wage tax rate for residents of Philadelphia was not increased and remains at 38712 038712.

The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for nonresidents is 34481 down from 35019 and the rate for residents is 38398 a decrease from the previous rate of 38712. Wages subject to unemployment contributions for employers remains at 10000. To qualify to pay the reduced income-based rates for Net Profits Tax you must be eligible for Pennsylvanias Tax Forgiveness Program.

The Federal income brackets are from 10 to 37 for the year 2021. Effective July 1 2021 tax rates are 38398 for Philadelphia residents and 34481. Since July 1 2021 the Philadelphia resident rate is 38398 and the.

City Wage Tax is imposed on all the wages for Philadelphia residents whether they work inside or outside of the city and on non-residents when they work in Philadelphia. For specific deadlines see important dates below. Residents of Philadelphia are taxed at a rate of 38712 percent.

FREE Paycheck and Tax Calculators. The rate as of July 1 2019 for residents of Philadelphia decreases from 38809 to 38712 and the rate for nonresidents of Philadelphia decreases from 34567 to 34481. This program is available to working families who have paid income tax throughout the year and meet certain income eligibility requirements based on household size and marital status.

Employers collect the Wage Tax from a workers paycheck and remit it to the. The standard deduction is 12550 single and 25100 married filing jointly for the year 2021. The Philadelphia Net Profits Tax NPT which is imposed on the net profits from the operations of a trade business profession enterprise of other activity.

From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center. 2 days agoWhen you focus on tax rates you quickly see that Philadelphias resident wage tax is higher than any other city in the nation except New York. Non-residents who work in Philadelphia are also subject to City Wage Tax but at the lower.

Philadelphia Income Tax Rate 2021. The City of Philadelphia wage tax is a tax on salaries wages commissions and other compensation paid to an employee who is employed by or renders services to an employer. Pennsylvania is one of just eight states that has a flat income tax rate and of those states it has the lowest rate.

The lower income-based rate is 15 percent for both residents and non-residents regardless of residency. City of Philadelphia Wage Tax. The Earnings Tax rates in the new fiscal year are therefore 38712 038712 for residents and 35019 035019 for non-residents.

Wages subject to unemployment contributions for employees are unlimited. For residents of Philadelphia or 34481 for non-residents. And because NYC has a progressive local income tax its higher rates apply only to higher-income householdsHigh tax rates mean less earned income goes into the pockets of our residents as demonstrated by studies.

For questions about City tax refunds you can contact the Department of Revenue by emailing the Tax Refund Unit or calling any of the following phone numbers. The new rates are as follows. For income-based rates to apply you must.

Residents of Philadelphia will pay a tax rate of 38809 percent for the 2018 tax year. Be certain your payroll systems are updated to reflect the increased non-resident tax rate. What Is Philadelphia City Wage Tax.

Quarterly plus an annual reconciliation. In the state of California the new Wage Tax rate is 38398 percent. The Wage Tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees paychecks.

Furthermore the rate of Earnings Tax for residents. All Philadelphia residents regardless of where they work are subject to Wage Tax at the rate of 38712. The new Wage Tax rate for residents of Philadelphia is 38809 038809.

Pennsylvania also levies local income taxes in more than 2500 municipalities. For residents and 34481 for non-residents. 2015 Philadelphia Wage Tax Reduction Philadelphia business owners and those that withhold taxes on employees that live in Philadelphia should take notice that the City of Philadelphia has reduced the City Wage Tax rate effective July 1 2015.

Single or Married Filing Separately.

Philadelphia Tax Rate Changes Starting July 1st Haefele Flanagan

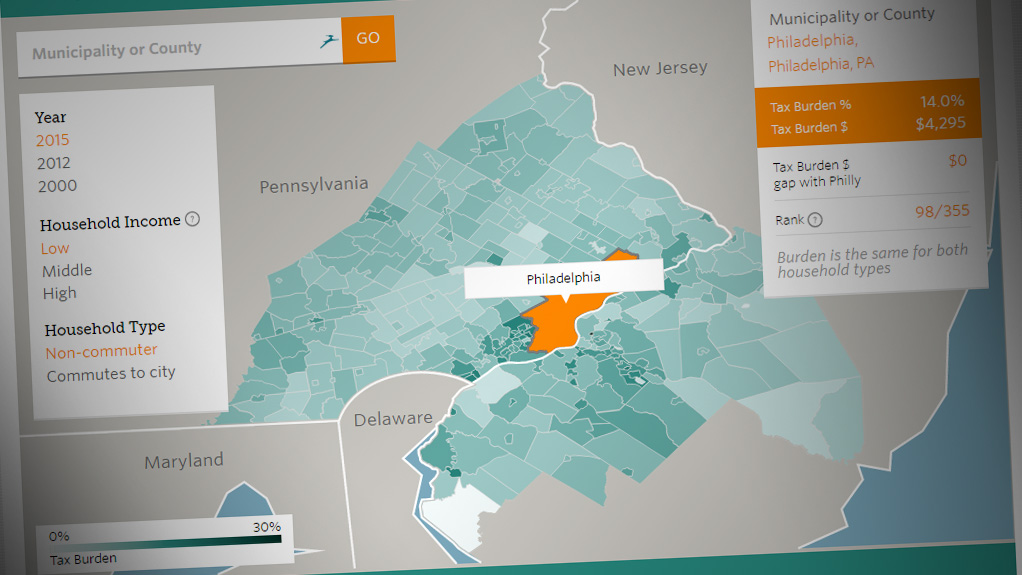

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Deciding Where To Retire Affects Both Your Lifestyle And Your Wallet During Retirement Part Of Successfully Planning Your Tax Deductions Tax Refund Tax Return

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

Live Casino Hotel Philadelphia Donated 15 000 To Philabundance For Hunger Relief Philadelphia Hotels Casino Hotel Casino

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

Tax Record Retention Guidelines Let S Get Organized What And When Can I Toss It Records Estate Administration Estate Planning

My Advice To Buyers When You Love The House But Your Spouse Doesn T New Spouses Are Easier To Find In This Market Than Ho When You Love Home Buying Sale House

2020 Philadelphia Tax Rates Due Dates And Filing Tips

![]()

Philadelphia Wage Tax Refunds What S New For 2020 Plenty

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

2020 Philadelphia Tax Rates Due Dates And Filing Tips

What Kind Of Corporation You Are Some Businesses Have To Pay Out A Flat Rate For Franchise Tax One B Tax Deductions Medical Device Sales Wage Garnishment

Philadelphia City Council Unveils 5b Budget Whyy

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Will You Have To Pay Taxes On Your Inheritance Property Management Real Estate Ads Management